What Is a Tax Rate?

A tax rate is a percentage at which an individual or corporation is taxed. Canada (both the federal government and many of the states) uses a progressive tax rate system, in which the percentage of tax charged increases as the amount of the person’s or entity’s taxable income increases. A progressive tax rate results in a higher dollar amount collected from taxpayers with greater incomes.

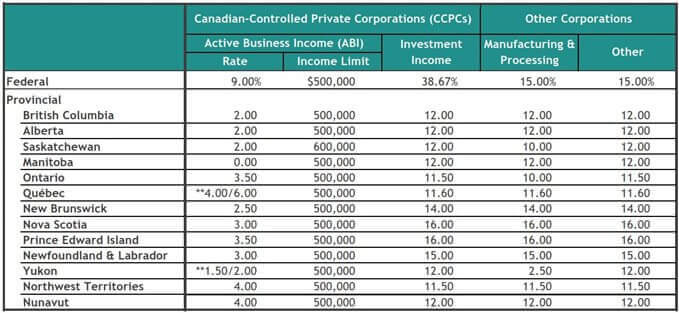

Corporate Income Tax Rates:

Federal tax rates for 2021

- 15% on the first $49,020 of taxable income, plus

- 20.5% on the next $49,020 of taxable income (on the portion of taxable income over 49,020 up to $98,040), plus

- 26% on the next $53,939 of taxable income (on the portion of taxable income over $98,040 up to $151,978), plus

- 29% on the next $64,533 of taxable income (on the portion of taxable income over 151,978 up to $216,511), plus

- 33% of taxable income over $216,511